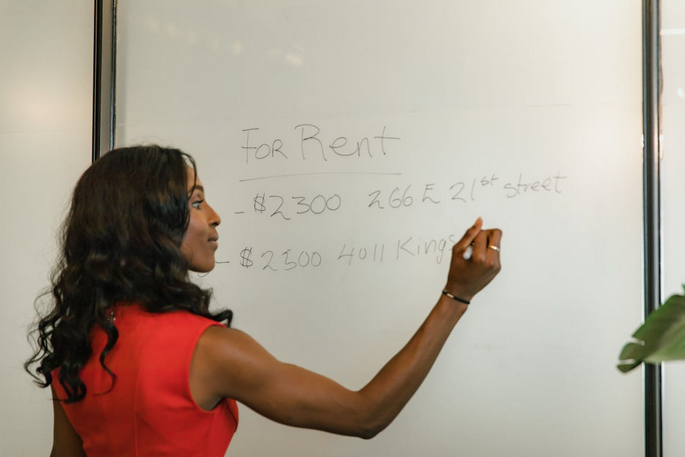

Borrowing money is a reality for many Canadians, whether it’s for a first home in Kitchener-Waterloo, a car in Saskatoon, or covering education costs in Halifax. While debt often gets a bad reputation, borrowing itself isn’t the problem—it’s how we approach it. When done thoughtfully, borrowing can support long-term goals rather than become a constant source of stress. Understanding the process, the rules, and your own financial habits can make a big difference in how confident you feel when taking on credit.

Understanding Why You’re Borrowing

One of the first steps to borrowing strategically is being clear about the “why.” Early in your research, you may find helpful educational resources and comparisons—many people click here to learn more while exploring how different loan types align with their goals and timelines. Are you borrowing to invest in something that improves your earning potential or quality of life, or are you filling short-term gaps that might signal a budgeting issue? In Canada, lenders often assess risk based on the purpose of the loan, and borrowers who understand their motivations tend to make better decisions.

Knowing How Canadian Credit Really Works

Canada’s credit system has its own nuances, and understanding them can immediately reduce anxiety. Your credit score, typically tracked by Equifax or TransUnion Canada, plays a significant role in the interest rates you’re offered. Unlike some other countries, Canadian lenders also factor in federal guidelines, such as OSFI’s mortgage stress tests. Keeping utilization low, paying on time, and avoiding frequent credit applications are especially important if you’re planning a major purchase within the next few years.

Choosing the Right Type of Lender

Not all lenders operate the same way, and in Canada, the differences can be significant. Different rules govern banks, credit unions, and alternative lenders, and consumer protections can vary by province. For example, payday loan regulations are much stricter in provinces like Ontario and British Columbia than they were a decade ago. Taking the time to compare options—and reading the fine print—can help you avoid high fees and unexpected conditions that add stress later.

Borrowing With Repayment in Mind

Strategic borrowing isn’t just about getting approved; it’s about having a realistic plan to pay the money back. Canadians often juggle multiple financial priorities, from RRSP contributions to rising housing costs. Before signing anything, map out how repayments fit into your monthly cash flow, even if interest rates rise. Fixed versus variable rates, prepayment options, and penalties for early payoff all matter more than many borrowers initially realize.

Using Borrowing as Part of a Bigger Financial Picture

Debt shouldn’t exist in isolation from the rest of your financial life. When borrowing is coordinated with savings tools like TFSAs, emergency funds, and insurance coverage, it becomes far more manageable. Many Canadians find that working with a financial advisor or using planning software helps them see how borrowing today affects their flexibility five or ten years down the road. This broader view often replaces stress with a sense of control.

Borrowing doesn’t have to feel overwhelming or risky. By understanding your reasons, learning how the Canadian system works, and thinking beyond approval to long-term impact, you can approach loans with confidence instead of fear. When borrowing is done strategically and thoughtfully, it becomes a tool—not a trap—helping you move forward with less stress and greater financial clarity.…

You might think you should put all your money on a single stock, a property unit, or just a safe full of gold bars. But let me tell you. This is a super risky move you need to avoid.

You might think you should put all your money on a single stock, a property unit, or just a safe full of gold bars. But let me tell you. This is a super risky move you need to avoid.  The best investment is yourself. In the end, you and only yourself can save your life. So, never stop learning new skills and expanding your knowledge. This way, you position yourself for long-term success in the financial world.

The best investment is yourself. In the end, you and only yourself can save your life. So, never stop learning new skills and expanding your knowledge. This way, you position yourself for long-term success in the financial world.

First things first, let’s understand what binary options trading is all about. Binary options are financial instruments that allow you to speculate on the price movement of various assets, such as stocks, currencies, commodities, or indices. Unlike traditional trading, binary options have a fixed payout and a predetermined expiration time. You either win a fixed amount if your prediction is correct or lose the invested amount if it’s not.

First things first, let’s understand what binary options trading is all about. Binary options are financial instruments that allow you to speculate on the price movement of various assets, such as stocks, currencies, commodities, or indices. Unlike traditional trading, binary options have a fixed payout and a predetermined expiration time. You either win a fixed amount if your prediction is correct or lose the invested amount if it’s not. Managing risk is crucial in any form of trading. Limit the amount you’re willing to risk per trade and stick to it. It’s generally recommended not to risk more than 2-3% of your trading capital on a single trade. Consider using stop-loss orders to automatically exit a trade if it moves against you. Diversify your portfolio by trading different assets and avoid putting all your eggs in one basket.

Managing risk is crucial in any form of trading. Limit the amount you’re willing to risk per trade and stick to it. It’s generally recommended not to risk more than 2-3% of your trading capital on a single trade. Consider using stop-loss orders to automatically exit a trade if it moves against you. Diversify your portfolio by trading different assets and avoid putting all your eggs in one basket.

One of the most important things you can do to become financially literate is to learn about saving for retirement. Retirement planning is a complex process, and there are many factors to consider, such as how much money you will need to have saved, how long you will need to support yourself, and what kind of lifestyle you want in retirement. The sooner you start saving, the more time your money has to grow. Even if you can only save a little bit each month, it will add up over time.

One of the most important things you can do to become financially literate is to learn about saving for retirement. Retirement planning is a complex process, and there are many factors to consider, such as how much money you will need to have saved, how long you will need to support yourself, and what kind of lifestyle you want in retirement. The sooner you start saving, the more time your money has to grow. Even if you can only save a little bit each month, it will add up over time. It can be tough to stay on top of your finances, especially if you’re dealing with a lot of debt. But being financially literate can help you make better decisions about your money and get out of debt more quickly. Financial literacy can help you understand your options and plan to get out of debt if you’re struggling. While there are many different reasons why people may find it difficult to save money, by understanding the basics of financial literacy and how to apply them, anyone can start becoming more financially responsible. Consider these tips to get started on your path to better financial health.…

It can be tough to stay on top of your finances, especially if you’re dealing with a lot of debt. But being financially literate can help you make better decisions about your money and get out of debt more quickly. Financial literacy can help you understand your options and plan to get out of debt if you’re struggling. While there are many different reasons why people may find it difficult to save money, by understanding the basics of financial literacy and how to apply them, anyone can start becoming more financially responsible. Consider these tips to get started on your path to better financial health.…

Many people believe that regularly checking their credit score will somehow lower it. However, this is not the case! Checking your credit score will not lower it; it can be a good thing. By regularly monitoring your score, you can catch any potential problems early on and take steps to improve your score. In addition, many credit card companies now offer free credit scores to their customers.

Many people believe that regularly checking their credit score will somehow lower it. However, this is not the case! Checking your credit score will not lower it; it can be a good thing. By regularly monitoring your score, you can catch any potential problems early on and take steps to improve your score. In addition, many credit card companies now offer free credit scores to their customers.

Another common myth about online payday loans is that they will only hurt your credit score. However, this is not necessarily true. If you can make your payments on time and in full, taking out a loan can actually help improve your credit score. On the other hand, if you’re late with your payments or default on your loan, your credit score will obviously be affected. So, if you’re thinking about taking out a loan, just be sure to stay on top of your payments, and you should be fine.

Another common myth about online payday loans is that they will only hurt your credit score. However, this is not necessarily true. If you can make your payments on time and in full, taking out a loan can actually help improve your credit score. On the other hand, if you’re late with your payments or default on your loan, your credit score will obviously be affected. So, if you’re thinking about taking out a loan, just be sure to stay on top of your payments, and you should be fine. Lastly, some think taking out an online payday loan will only facilitate unhealthy financial habits. However, this is not necessarily true. If you can manage your finances responsibly, then a payday loan can be a great tool to help you in a time of need. On the other hand, if you’re not careful with your spending, then yes, a payday loan can end up being more harmful than helpful. So, if you’re thinking about taking out a loan, just be sure to use it wisely, and you should be fine.

Lastly, some think taking out an online payday loan will only facilitate unhealthy financial habits. However, this is not necessarily true. If you can manage your finances responsibly, then a payday loan can be a great tool to help you in a time of need. On the other hand, if you’re not careful with your spending, then yes, a payday loan can end up being more harmful than helpful. So, if you’re thinking about taking out a loan, just be sure to use it wisely, and you should be fine.

Probably the most crucial aspect that financial management education does is it helps children develop good financial habits. Just like any other habit, developing good financial habits takes time and repetition. But if kids learn about money early on and are taught how to handle it responsibly, they will be more likely to carry those habits into adulthood. With a good understanding of money and how it works.

Probably the most crucial aspect that financial management education does is it helps children develop good financial habits. Just like any other habit, developing good financial habits takes time and repetition. But if kids learn about money early on and are taught how to handle it responsibly, they will be more likely to carry those habits into adulthood. With a good understanding of money and how it works.

One of the most important things you can do to maintain a good credit score is to pay your bills on time. This includes your mortgage, car payment, credit card bills, and any other type of loan you may have. If you have trouble making ends meet, contact your creditors and work out a payment plan. They would rather receive partial payments than no payments at all.

One of the most important things you can do to maintain a good credit score is to pay your bills on time. This includes your mortgage, car payment, credit card bills, and any other type of loan you may have. If you have trouble making ends meet, contact your creditors and work out a payment plan. They would rather receive partial payments than no payments at all. One way to keep your credit score high is by minimizing the number of credit card applications you make. Every time you apply for a new credit card, the issuer will run a hard inquiry on your credit report. This can temporarily lower your score by a few points. So if you don’t need a new credit card, it’s best to avoid applying for one.

One way to keep your credit score high is by minimizing the number of credit card applications you make. Every time you apply for a new credit card, the issuer will run a hard inquiry on your credit report. This can temporarily lower your score by a few points. So if you don’t need a new credit card, it’s best to avoid applying for one. One of the key ingredients to a good credit score is having a healthy savings account. This demonstrates to potential lenders that you can manage your money and make payments on time. If you don’t have much saved up, start small by setting aside $20 from each paycheck into a savings account. Once you have a few months’ worths of expenses saved up, you can begin to focus on other financial goals.

One of the key ingredients to a good credit score is having a healthy savings account. This demonstrates to potential lenders that you can manage your money and make payments on time. If you don’t have much saved up, start small by setting aside $20 from each paycheck into a savings account. Once you have a few months’ worths of expenses saved up, you can begin to focus on other financial goals.

Another advantage of hiring a credit repair company is that it can save you money in the long run. If you try to fix your credit on your own, there’s a good chance you will make mistakes that could end up costing you more money. A credit repair company has the experience and knowledge to get the job done right the first time. This can save you a lot of money in the long run.

Another advantage of hiring a credit repair company is that it can save you money in the long run. If you try to fix your credit on your own, there’s a good chance you will make mistakes that could end up costing you more money. A credit repair company has the experience and knowledge to get the job done right the first time. This can save you a lot of money in the long run. Lastly, a credit repair company has access to many resources that you may not have. This includes a team of experts who know the ins and outs of credit repair. They also have software that can help automate the process. This means they can get the job done much faster than you could on your own. In addition, they have established relationships with the credit bureaus.

Lastly, a credit repair company has access to many resources that you may not have. This includes a team of experts who know the ins and outs of credit repair. They also have software that can help automate the process. This means they can get the job done much faster than you could on your own. In addition, they have established relationships with the credit bureaus.

Credit utilization is the amount of credit you are using compared to the amount of available

Credit utilization is the amount of credit you are using compared to the amount of available

The annual percentage rate (APR) is another essential factor when considering a personal loan. This number reflects the amount of interest charged on your loan each year, and it can vary significantly from lender to lender. It’s essential to understand how the APR works before signing any paperwork because this number can significantly impact your monthly payments.

The annual percentage rate (APR) is another essential factor when considering a personal loan. This number reflects the amount of interest charged on your loan each year, and it can vary significantly from lender to lender. It’s essential to understand how the APR works before signing any paperwork because this number can significantly impact your monthly payments.

If you intend to hold some precious metals in your IRA account, you should first of all set up a self-directed IRA. You can manage this account by yourself directly through a custodian; usually, a financial institution approved to carry out IRS transactions. This institution can either be a bank, a brokerage firm, or a trusted firm.

If you intend to hold some precious metals in your IRA account, you should first of all set up a self-directed IRA. You can manage this account by yourself directly through a custodian; usually, a financial institution approved to carry out IRS transactions. This institution can either be a bank, a brokerage firm, or a trusted firm. The investment options in this world are many, and even when it comes to IRAs, investors cannot be short of options. Because of this, you can be wondering why to go for gold IRAs. Every investment option has its advantages, but gold IRAs eclipses many of these options because of their unmatched benefits.

The investment options in this world are many, and even when it comes to IRAs, investors cannot be short of options. Because of this, you can be wondering why to go for gold IRAs. Every investment option has its advantages, but gold IRAs eclipses many of these options because of their unmatched benefits.

By using software, the rate at which the company processes your claims is increased. In this way, customers can expect quick outcomes. Also, it helps improve the efficiency and convenience of processing insurance claims. Your customers can enjoy the improved efficiency. This can help you to retain customers.

By using software, the rate at which the company processes your claims is increased. In this way, customers can expect quick outcomes. Also, it helps improve the efficiency and convenience of processing insurance claims. Your customers can enjoy the improved efficiency. This can help you to retain customers. It is advisable to purchase your software from an established company. Avoid getting your claims software from companies that are new to the market. An established software development company knows what insurance companies are looking for.

It is advisable to purchase your software from an established company. Avoid getting your claims software from companies that are new to the market. An established software development company knows what insurance companies are looking for.

Getting into any form of investment, be it bonds or stocks, you will later notice that it is time-consuming, bothersome, and traditionally complicated. In other words, many investment opportunities have a high entry threshold. For some, you may need a significant sum at your disposal to get started.

Getting into any form of investment, be it bonds or stocks, you will later notice that it is time-consuming, bothersome, and traditionally complicated. In other words, many investment opportunities have a high entry threshold. For some, you may need a significant sum at your disposal to get started. Yes, a bail bond necessary to stay out of jail. It will help you save money so that you can use your bail money on other activities. When you have an agent by your side, you can also save time on doing all the paperwork since the agent will be responsible.

Yes, a bail bond necessary to stay out of jail. It will help you save money so that you can use your bail money on other activities. When you have an agent by your side, you can also save time on doing all the paperwork since the agent will be responsible.

committed, either the judge or the police will decide the bail amounts. The defendant has to pay the full fixed bail amount for their release from custody. It is in this scenario where the bail bonds company steps in to pay for the defendant and consigns that the defendant will appear before the court hearings too.

committed, either the judge or the police will decide the bail amounts. The defendant has to pay the full fixed bail amount for their release from custody. It is in this scenario where the bail bonds company steps in to pay for the defendant and consigns that the defendant will appear before the court hearings too.